Marium Akhtar

Online gaming has become a profitable business that has contributed millions to global economies. During COVID-19, it became the most prominent mobile app category, generating 50% of global app revenue. Technological advancements like Cloud, Virtual Reality (VR), and Augmented Reality (AR) are expanding the gaming market in Asia and emerging economies, creating new opportunities for game developers. The global gaming industry is expected to reach US$ 321 billion by 2026, driven by innovation, user demand, and the digital landscape (Figure 1).

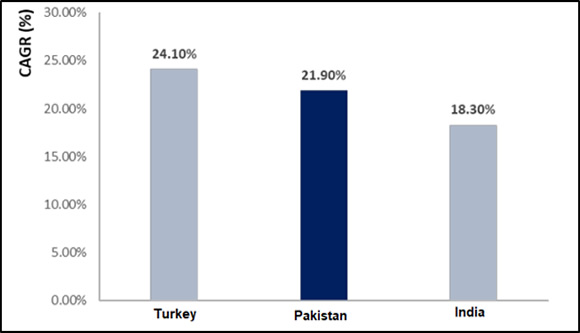

Asia-Pacific region is expected to remain the world's most significant digital gaming market, as 45% of world online gaming players have an annual growth rate of 3.4 %, making it a target for gaming companies. In global comparison, the highest revenue so far has been recorded by China, amounting to US$ 42bn in 2023. China and the US have dominated the market in 2021; however, according to recent surveys, future growth could come from less wealthy countries with growing populations. Reports predict that the games market will expand fastest in Turkey, with an average annual growth of 24.1% between 2021 and 2026. It will be followed by Pakistan, an upcoming market, with an expansion of 21.9%, and India at 18.3% (Figure 2).

Pakistan's gaming industry is poised to benefit from its young population of 64%, with 62% playing video games. 26.9 million Pakistanis play online games, with an average gamer spending 6 hours per week. The market was projected to reach US$200m by 2023. However, the combined revenue of the Animation Gaming and Graphics Sector grew from US$ 108 million in FY 20-21 to US$ 300 million in FY 22-23, demonstrating a promising growth of 180%. The gaming industry alone is expected to attain an annual growth rate of 9.77% by 2027. It is estimated that by 2026, the number of gamers will rise to 50.9 million.

Pakistan's gaming industry experienced growth in 2022, thanks to Google's first Gaming Growth Lab and government support from the Pakistan Software Export Board (PSEB) and National Information & Communication Technology & Research and Development (ICT R&D) Fund initiatives. As of 2023, Pakistan has 257 game development companies and 300 gaming studios. The country has a talented pool of 8500 game developers and players who won awards like the Develop Industry Excellence Award in 2014 and the Dota 2 Asian Championship in 2015. Pakistani games like Lost Twins 2 and Explottens have won international awards. Meanwhile, ‘Gamer Pakistan,’ a Pakistan-based Esports company, became the first entity listed on the US stock exchange in October 2023.

The game development industry, despite its significant profitability, faces challenges such as (1) academic, (2) infrastructural, (3) regulatory, and (4) social obstacles that hinder its full utilisation. In the academic domain, challenges include outdated curricula, lack of academia-industry linkages, and teaching competencies. Pakistan's higher education system must improve its learning process around Science, Technology, Engineering and Mathematics (STEM) to prepare its workforce for IT-related jobs. Regular updates of curricula at universities and the incorporation of industry experts in academia can help students produce high-quality products and compete globally.

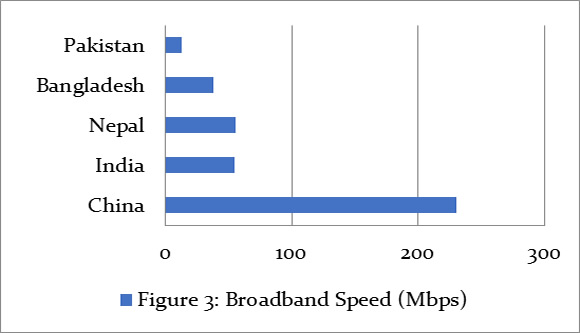

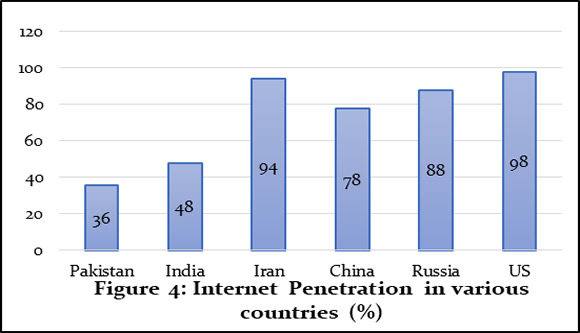

Inadequate infrastructure, such as unreliable connectivity, frequent power outages, slow internet speeds, and the rural-urban digital divide, hinders productivity and deters foreign investors. In broadband speed and internet penetration, Pakistan stands at 13 Mbps and 36%, respectively, the lowest in the region, as shown in Figures 3 and 4.

Investment in infrastructure to enhance rural internet access, build new cables, and expand networks while subsidising telecom companies to make it more affordable will yield better results for the gaming industry while reducing the digital divide across the country.

IT services and freelancers' income was tax-exempted in the regulatory domain, with 80% remitted to Pakistan as foreign exchange. However, this exemption was withdrawn in July 2022, obligating freelancers and IT service exporters to pay taxes. Limited funding access is a significant challenge Pakistani game developers and companies face, necessitating financial measures like tax redemption and incentives to encourage growth and development.

Pakistan's Personal Data Protection Bill 2023 faces debate due to potentially stringent data localisation requirements and increasing cybercrime. The bill is awaiting approval from the National Assembly, but local stakeholders, as well as international organisations and tech giants like Asia Internet Coalition (AIC), Privacy International, Google, Facebook, and Amazon that the proposed bill will burden businesses, inhibiting foreign companies from working inside Pakistan. To guarantee stakeholder acceptance, lawmakers should reevaluate approval and make any required changes transparently, as it will affect the nation's IT ecosystem.

The absence of international payment gateways has been a pressing hurdle in the way of Pakistan’s IT industry boost. However, the recent arrival of PayPal's payment gateway via a third-party intermediary will provide a streamlined approach towards efficient remittance solutions, which is a big step in uplifting the IT industry.

Pakistan's growing population demands fiscal resources, necessitating public-private partnerships for procurement and financing. Moreover, International partnerships are crucial for the local gaming and animation industry's creativity, exposure, and business ventures. Recently, Ufone 4G has partnered with PUBG Mobile through GameKey for collaborative gaming activities, demonstrating the importance of these initiatives.

Certain stigmas are attached to game development as a career, as the gaming industry is not mainstream. Pakistan’s family values and culture prefer conventional career paths over high-risk and high-economic returns. Increasing awareness about positive aspects of gaming, such as economic contribution, skill development, and exposure, can help parents realise the potential of gaming as a profitable and progressive career path.

The gaming community should be fostered through competitions, game jams, hackathons, boot camps, and conferences, involving all stakeholders and encouraging physical and mental health. Countries with substantial gaming industries, like the US and China, have taken a few steps to cope with the psychological and physical risks posed by online gaming. These include gaming restrictions for minors, anti-addiction mechanisms regulated by the government, education and awareness campaigns, and online safety initiatives for parents. Pakistan can also move in a similar direction as the industry grows to cope with the associated mental and physical risks.

The gaming industry in Pakistan can enhance its brand and international image, attract international gamers, and contribute to tourism and hospitality. The industry is expected to reach an estimated annual revenue of US$ 227.40 million by 2026. Hence, with a large, young population, skilled developers, and government support, it could export services abroad and significantly contribute to the country's economy and the global gaming industry.